Instagram Money Flipping Scam Exposed: How To Protect Yourself

Don’t fall for the Instagram money flip scam. Read this expert guide to protect your wallet, report fraud, and outsmart scammers today.

Jun 11, 2025

Instagram, a platform built on trust, connections, and aesthetic appeal, has become a prime hunting ground for digital con artists. With millions engaging daily, scammers exploit this trust to promise easy money through what’s known as the “Instagram money flipping scam.”

At first glance, the scam appears harmless-someone offers to turn $100 into $1,000. The pitch is clean, flashy, and “verified.” But behind the glam lies one of the most sophisticated digital frauds that continues to rob users of their money, identity, and security.

Let’s break down exactly how it works, why it’s so effective, and how you can protect yourself before it’s too late.

1. What Is The Instagram Money Flipping Scam?

Money flipping scams on Instagramare a type of investment fraud. Scammers promise users that they can multiply a small amount of money into a much larger sum-often claiming returns of 10x or more within a few hours.

They typically pose as:

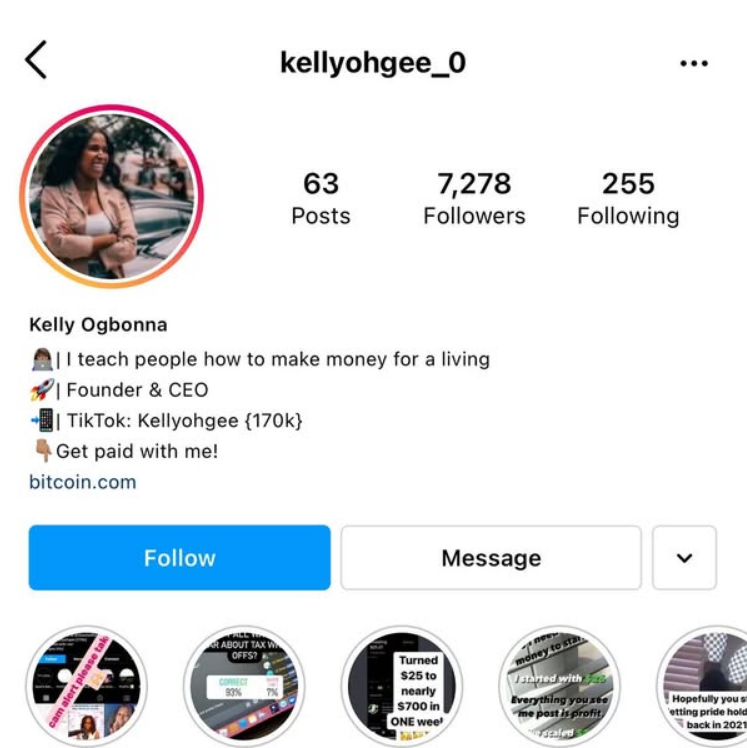

- "Financial experts" with flashy profiles

- Cryptocurrency traders showing “proof” of success

- Fake business accounts impersonating real influencers

- Hacked verified accounts of celebrities or influencers

The common denominator? Unrealistic promises. If you send them $100 via CashApp, Venmo, Zelle, or crypto-they’ll supposedly flip it into $1,000. But once you send the money, they vanish.

2. How Scammers Operate Step-by-Step

Understanding the scam mechanics helps you avoid the trap. Here's how it typically unfolds:

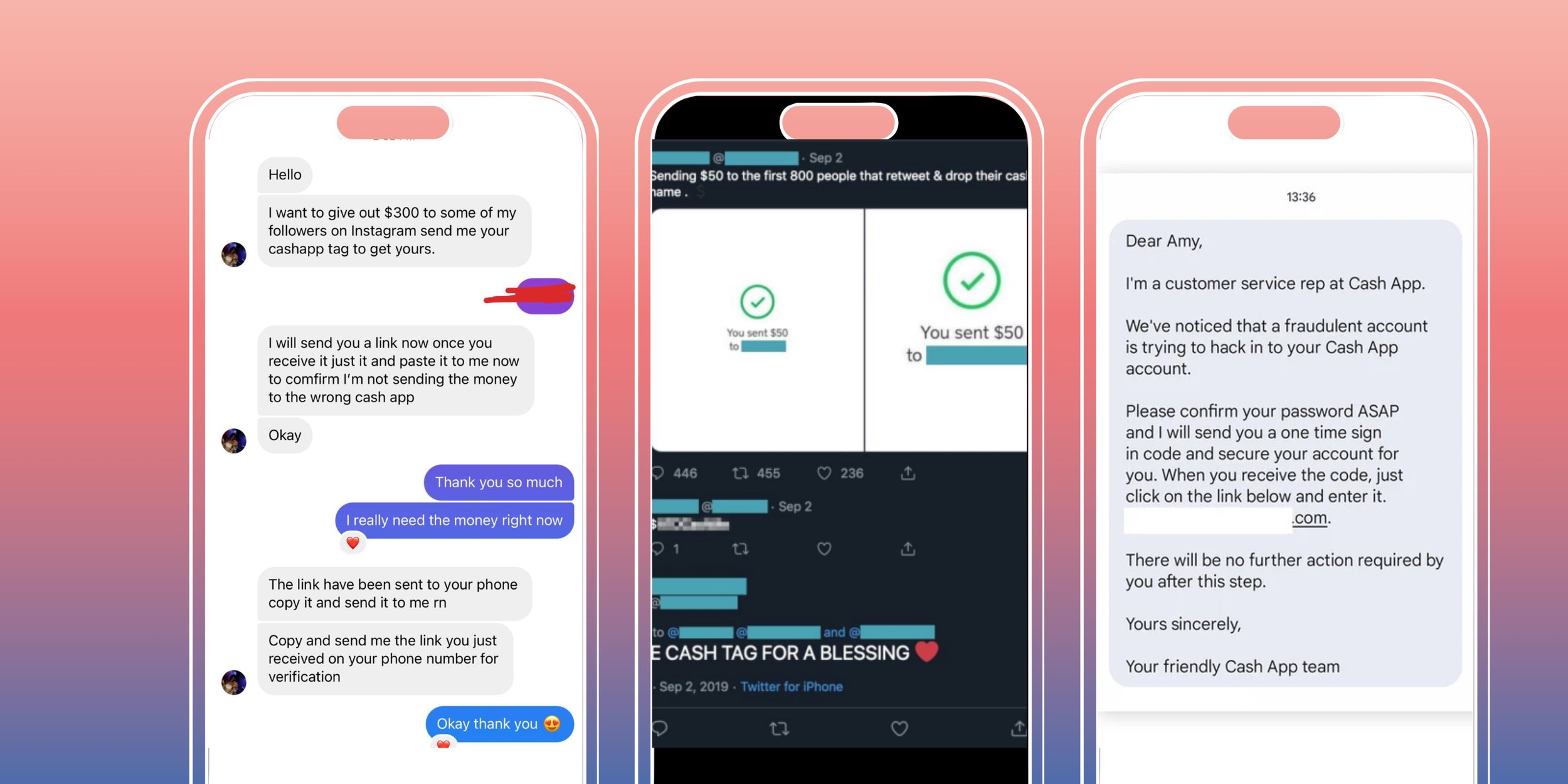

- Initial Hook:The scammer initiates contact via a direct message (DM) or a comment, often promising to "flip" your money for a significant profit.

- Fake Credibility Building:They attempt to appear legitimate by showcasing doctored screenshots of successful transactions, fabricated testimonials from "satisfied clients," and sometimes even staged videos.

- Small Money Request:They will ask you to send a relatively small amount of money initially, often ranging from $50 to $500, as a "test" or to "get started."

- Excuse and Delay:Once you send the initial amount, the scammer will often claim an unexpected issue has arisen, such as a need for "processing fees" or a requirement to "unfreeze" the payout, demanding more money.

- Ghosting or Threats:Ultimately, the scammer will either block you and disappear, deleting their account, or in some more aggressive cases, threaten to expose you if you refuse to pay more.

Don't Miss: 21 Real Ways To Make Real Money Online Today In <year>

3. Recognizing The Red Flags: Identifying Deception

The Allure of Unrealistic Returns:Legitimate investments inherently involve risk, and the promise of guaranteed, exceptionally high returns, especially within short timeframes, is a fundamental impossibility. Exercise extreme caution towards anyone making such assurances – they are almost certainly engaged in a scam.

The Pressure of Urgency:Scammers frequently employ high-pressure tactics, claiming that the "opportunity" is fleeting, exclusive, or available only for a limited time. This manufactured urgency is designed to bypass critical thinking and prevent victims from conducting thorough research.

Demands for Upfront Payments:Reputable investment platforms and advisors typically do not require substantial upfront fees before any profits are realized. Demands for payments labeled as "processing fees," "taxes," or "insurance" are classic hallmarks of fraudulent schemes.

Lack of Transparency and Regulation:Money flipping operations often deliberately obscure their investment strategies and the entities behind them. They typically lack registration with recognized financial regulatory bodies, a significant warning sign.

Unprofessional Communication:Despite their polished Instagram facades, direct interactions with scammers can often reveal a lack of professionalism, characterized by poor grammar, excessive use of emojis, aggressive sales pitches in DMs, or vague explanations.

Dubious Testimonials:Be highly skeptical of testimonials that seem generic, repetitive, or lack specific details and verifiable sources. Scammers frequently create fake profiles or pay individuals to endorse their schemes.

Preference for Untraceable Payment Methods:Scammers often steer victims towards payment methods that are difficult to trace or reverse, such as cryptocurrency (especially to unknown wallets on unregulated exchanges), wire transfers through services like Western Union or MoneyGram, or prepaid debit cards.

Too-Good-to-Be-True Offers on Small Investments:Be extremely cautious of profiles promising exceptionally high returns on relatively small initial investments.

Pushy Urgency:Watch out for phrases like "Only 3 spots left!" or "Act now or miss out!" designed to create a sense of immediate need to invest.

4. Why These Scams Are So Convincing: The Psychology At Play

Scammers are adept at exploiting psychological vulnerabilities and leveraging social proof to appear legitimate:

- Real-Looking Profiles:They often use stolen photos, bios, and even reels to create profiles that appear genuine and trustworthy.

- High Follower Counts:While often fake or purchased, a high number of followers can create an illusion of popularity and legitimacy.

- Emotionally Charged Pitches:They often use emotionally charged language ("Don't miss this chance to escape the 9-to-5!") to appeal to desires for financial freedom or to exploit feelings of desperation.

- Time Pressure:Creating a sense of urgency with limited-time offers or countdowns can rush victims into making impulsive decisions.

- Trusted Platform Bias:Some individuals may assume that because an account is on a platform like Instagram, especially if it's verified (though verification can also be faked or accounts hacked), it must be legitimate.

5. Strategies For Protection

Cultivate A Strong Sense Of Skepticism

Approach any unsolicited investment offers encountered on social media with a critical and questioning mindset. Always remember: if an offer appears too good to be true, it invariably is.

Conduct Thorough Due Diligence

Before entrusting anyone with your money, rigorously research the individual or entity offering the "opportunity." Seek independent reviews, verify their registration with relevant financial authorities in your region (e.g., your local Securities Commission or Consumer Protection Agency), and be extremely cautious if information is scarce or unverifiable.

Resist The Urge To Rush

Legitimate investment opportunities allow for careful consideration and thorough research. Do not succumb to pressure tactics that demand immediate investment.

Steer Clear Of Unfamiliar Payment Channels

Be wary of requests to send funds via cryptocurrency (especially to unknown wallets on unregulated exchanges), wire transfers, or prepaid debit cards, as these often lack strong fraud protection or traceability.

Opt for reputable and secure payment platforms. Never send money to strangers via cash apps like Venmoor CashApp, or through cryptocurrency for "money flipping."

Don’t Click Suspicious Links In DMs

Be cautious of any links sent via direct message from accounts you don't know or trust, as these could lead to phishing sites or other malicious content.

Verify Influencer Promotions

If an offer is being promoted by an influencer, do your own independent research before trusting it. Influencers may not always conduct thorough due diligence on the products or services they endorse.

Enable Two-Factor Authentication (2FA):Secure your own Instagram account (and other online platforms) with two-factor authentication to prevent unauthorized access, especially if you have shared any login details with suspicious individuals.

Limit Public Profile Information

Reduce the amount of personal information visible on your public profile, as scammers can use this information for social engineering tactics.

Avoid Engaging With "Money Flipping" Offers

The best way to protect yourself is to simply avoid engaging with any accounts or messages offering to "flip" your money.

Seek Guidance From Certified Financial Advisors

Before making any investment decisions, consult with a licensed and reputable financial advisor. They can provide unbiased advice tailored to your financial situation and goals.

Critically Evaluate Claims And Testimonials

Do not accept testimonials or claims of success at face value. Demand verifiable evidence and be aware that digital content can be easily manipulated.

Safeguard Your Personal Information

Exercise caution when sharing sensitive personal or financial details with unverified individuals or platforms. Scammers can exploit this information for identity theft or other malicious activities.

Trust Your Intuition

If a situation feels "off" or too good to be true, it likely is. Heed your gut instincts and do not disregard red flags.

6. If You've Been Targeted Or Scammed: Immediate Actions And Legal Recourse

If you find yourself targeted by a money flipping scam or, worse, have already sent money, take immediate action:

- Report the Account Directly to Instagram:Use Instagram's built-in reporting tools to flag the account as a scam. You can find instructions here: https://help.instagram.com/

- Block and Unfollow the Account:Prevent any further contact from the scammer.

- Notify Your Bank or Payment Service:Contact your bank or the payment service you used (e.g., Venmo, CashApp, cryptocurrency exchange) immediately to report the fraudulent transaction and inquire about the possibility of a reversal or dispute.

- Change Your Passwords:If you have shared any login details with the scammer, change your passwords across all your online accounts.

- Enable Two-Factor Authentication (2FA):Secure your Instagram account and other platforms with 2FA to prevent unauthorized access.

Legal Actions You Can Take

If you have suffered financial losses, consider taking the following legal steps:

- File a Complaint with the FBI Internet Crime Complaint Center (IC3):This is a crucial step for reporting internet-based crimes: https://www.ic3.gov

- Contact the Federal Trade Commission (FTC):The FTC collects reports of fraud and scams: https://reportfraud.ftc.gov

- Report to Your Local Law Enforcement:File a police report with your local authorities, providing them with all screenshots and transaction records.

- Consult a Consumer Protection Attorney:For significant financial losses, consider seeking advice from a consumer protection attorney to explore potential legal options for restitution.

Remember:These scams are financial crimes. Reporting them helps authorities track patterns and potentially shut down these operations.

7. The Role And Responsibility Of Social Media Platforms

While social media platforms like Instagram offer numerous benefits for connection and commerce, they also present avenues for fraudulent activities due to the ease of creating deceptive profiles and reaching vast audiences.

Instagram states that it prioritizes user safety and has implemented measures to combat scams, but these still occur due to:

- Inconsistent Content Moderation:The sheer volume of content makes consistent and immediate moderation challenging.

- Slow Response to Scam Reports:Users may experience delays in the platform's response to reported scam accounts.

- Poor Account Recovery Options After Hacks:If a legitimate account is compromised and used for scams, recovery can be difficult.

However, Instagram has introduced features aimed at improving safety, including:

- Stronger Verification for Business Accounts:Enhancing the legitimacy of verified business profiles.

- AI Moderation Tools:Utilizing artificial intelligence to detect and remove potentially harmful content, including scams.

- Warning Screens for Suspicious DMs:Alerting users when they receive messages from accounts that may be involved in scams.

Ultimately, while platforms have a responsibility to implement and improve safety measures, users must remain vigilant and take proactive steps to protect themselves.

8. Navigating Legitimate Online Financial Opportunities

It's crucial to understand that genuine financial growth typically requires time, effort, and carries inherent risks. There are no legitimate "get rich quick" schemes.

Explore established investment avenues such as stocks, bonds, mutual funds, and real estate through reputable and regulated financial institutions.

Educate yourself about personal finance and investing through credible sources and consider seeking guidance from certified financial advisors.

Be extremely wary of any online opportunities that promise unusually high returns with little to no risk. Legitimate online income generation often involves freelancing, e-commerce, content creation, or other services that require effort and skill.

Related Reading: How To Make Money Writing EBooks: The Easiest Path To Profits

FAQs About Instagram Money Flipping Scams

What Is A Money Flipping Scam On Instagram?

It’s a fraud where scammers promise to multiply your money (e.g., turn $100 into $1,000), but once you send money, they disappear or ask for more.

Why Do People Fall For Money Flipping Scams?

Scammers use emotional manipulation, fake credibility, and urgency to exploit users—especially those in financial distress.

Can Instagram Refund My Money If I Get Scammed?

No. Instagram doesn’t handle financial transactions and can’t issue refunds. You must contact your bank or payment provider.

How Can I Spot A Scam Account?

Look for poor grammar, too-good-to-be-true promises, high follower counts but low engagement, and suspicious messages offering fast money.

Can I Press Charges Against An Instagram Scammer?

Yes, in theory. You can report them to law enforcement or federal agencies, but prosecution is difficult unless large sums or multiple victims are involved.

Final Words

Scammers prey on hope. They twist trust, glamorize fraud, and leave behind broken bank accounts and bruised egos.

But awareness is your strongest shield.

By understanding how these scams work, watching for the warning signs, and knowing how to respond, you can shut them down before they start. Don’t just protect your money-protect your voice, identity, and peace of mind.

Also Check Out: Make Money Affiliate Marketing: Is It Truly Possible? [Revealed]